Table of Contents

Have you ever wondered why lithium is often called the backbone of the green energy revolution? This versatile metal is at the heart of the clean energy transition, powering everything from electric vehicles (EVs) to energy storage solutions.

With its growing demand, lithium stocks have become a hot commodity for savvy investors, especially as industries worldwide prioritise sustainability.

5StarsStocks.com has positioned itself as a reliable resource for those seeking to capitalise on this booming market. By exploring expert recommendations and market insights, you can unlock the potential of lithium investments in 2025.

This blog takes a closer look at why lithium stocks are soaring and how 5StarsStocks.com Lithium can help you make smarter investment choices.

What Are 5StarsStocks.com Lithium Stocks?

5StarsStocks.com is a trusted platform offering valuable insights into lithium stocks, catering to both new and experienced investors.

The site provides expert advice on high-potential stocks in the expanding lithium market, with a particular focus on companies involved in lithium mining, battery production, and energy storage technologies.

For 2025, 5StarsStocks.com highlights top-performing lithium stocks based on current market trends and future projections, helping investors make informed decisions.

The platform simplifies research by offering detailed breakdowns of industry leaders and emerging players, ensuring users can easily navigate the market landscape.

With its user-friendly interface and exclusive analysis, 5StarsStocks.com acts as a go-to resource for anyone looking to capitalise on the lithium boom.

By visiting the site, investors can access stock performance data, expert tips, and strategies to diversify their portfolios and take advantage of the growth potential in the lithium sector.

What Makes Lithium the “Gold” of the Green Energy Revolution?

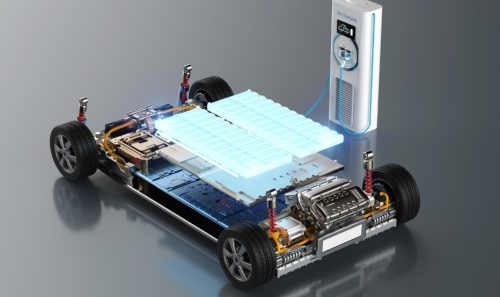

Lithium is often referred to as “white gold” because of its crucial role in the global shift toward clean energy solutions.

It powers the batteries that drive electric vehicles, store renewable energy, and operate countless consumer devices.

Its unique properties, such as its lightweight nature and high energy density, make it indispensable for green technologies.

Key Reasons Lithium is Critical

- Electric Vehicle Growth: Lithium-ion batteries are the preferred energy source for EVs. As governments push for zero-emission vehicles, lithium demand skyrockets.

- Energy Storage Systems: Renewable energy sources like solar and wind require efficient storage solutions, and lithium batteries are the go-to choice.

- Consumer Electronics: From smartphones to laptops, lithium powers the devices that are integral to our daily lives.

In the broader context, lithium is essential for achieving global sustainability goals. Its unique properties and wide-ranging applications make it a linchpin for industries transitioning to greener operations.

Why Should You Invest in Lithium Now?

The timing to invest in lithium has never been better, as the market shows exponential growth potential.

By 2025, global lithium demand is expected to reach unprecedented levels, driven by the expanding electric vehicle industry and clean energy policies.

Reasons to Invest Now:

High Demand

- The surge in electric vehicle (EV) sales is driving the demand for lithium batteries. As more consumers switch to EVs, the need for lithium grows exponentially.

- This trend is expected to continue, pushing lithium demand to all-time highs.

Government Support

- Governments worldwide are implementing policies to boost the adoption of EVs and renewable energy.

- Subsidies, tax incentives, and regulations favouring clean energy projects are accelerating the growth of the lithium market. These supportive measures will help sustain demand for lithium.

Scarcity and Value

- Lithium is a finite resource, with global reserves becoming increasingly scarce. As the demand for lithium rises, its value is expected to increase.

- This limited supply, combined with growing demand, makes lithium an increasingly valuable asset.

The opportunity to invest early in a growing market can result in significant returns. Whether you’re an experienced investor or just starting out, lithium stocks represent a strategic move toward a sustainable and profitable future.

How Has the Demand for Lithium Stocks Changed Over the Years?

The demand for lithium stocks has grown significantly over the past decade, reflecting the shift toward clean energy and EV adoption.

From 2015 to 2020, the global lithium market expanded as EVs began gaining mainstream attention. By 2023, lithium stocks were among the top-performing investment options, primarily due to the booming renewable energy sector.

Projections for 2025 indicate even higher demand as battery technology continues to advance. Companies involved in lithium mining and production are seeing increased stock prices, making them attractive options for investors.

5StarsStocks.com has consistently highlighted these trends, providing valuable insights into the evolving market and helping investors make informed decisions.

Why Are Lithium Stocks Crucial for the Electric Vehicle Industry?

The electric vehicle (EV) industry is a primary driver of lithium demand. Lithium-ion batteries are essential for EVs, offering the high energy density and long lifespan needed to power modern electric cars. Lithium’s Role in EV Growth:

Battery Technology

Lithium is essential for the production of electric vehicle (EV) batteries, enabling the range and efficiency that consumers demand. Without lithium, EVs would struggle to meet performance expectations.

Cost Reduction

As lithium becomes more readily available, the cost of producing EV batteries decreases. This reduction in costs leads to more affordable electric vehicles for consumers.

Supply Chain Stability

Companies that ensure a stable supply of lithium are positioned to lead the EV market. A secure lithium supply chain gives these companies a competitive edge in meeting growing demand.

With EV adoption on the rise globally, investing in lithium stocks now means aligning your portfolio with one of the fastest-growing industries.

What Does 5StarsStocks.com Recommend for Lithium Stock Investments in 2025?

As the demand for lithium continues to surge, driven by the electric vehicle (EV) boom and renewable energy innovations, 5StarsStocks.com has identified five standout lithium-related stocks for 2025.

These stocks hold promising growth potential, making them valuable additions for UK investors exploring opportunities in the evolving energy landscape.

Top Lithium Stocks to Watch

1. Albemarle Corp. (ALB)

Albemarle dominates the global lithium market with a strong client base, including Tesla and Panasonic, and continues to expand aggressively with strategic acquisitions like its bid for Liontown Resources.

- Market cap: $14.508 billion, reflecting its leadership in the sector.

- Net income growth: 35.7% year-over-year, showcasing financial strength.

- Dividend yield: 1.30%, appealing to income-focused investors.

2. Mineral Resources Ltd. (OTC: MALRY)

This Australian company combines its leadership in lithium mining with diversified operations in commodities like iron ore, positioning itself as a resilient player in the global market.

- Market cap: AUD 10.56 billion, underlining its stability.

- Net income growth: 105.5%, a testament to robust performance.

- Dividend yield: 3.43%, providing consistent returns to shareholders.

3. Arcadium Lithium PLC (ALTM)

Following the Allkem-Livent merger, Arcadium Lithium has emerged as a major player with a diverse portfolio and significant operational strength across key lithium markets worldwide.

- Revenue growth: 51.39%, reflecting strong demand for lithium.

- Projected EPS rebound in 2024, highlighting growth potential.

- Focus: Efficient production of lithium carbonate and hydroxide.

4. Lithium Americas Corp. (LAC)

With the ambitious Thacker Pass project in Nevada, Lithium Americas leverages strategic financial backing and partnerships to solidify its future in lithium production.

- A $2.26 billion loan from the U.S. Department of Energy ensures strong financial support.

- Key partnership with General Motors highlights investor confidence.

- Diverse portfolio, including significant projects in Argentina.

5. Tesla Inc. (TSLA)

Tesla’s proactive approach to lithium sourcing and refining complements its EV dominance, ensuring a secure supply chain for its innovative battery technologies.

- Strategic partnerships with junior lithium miners to secure future supplies.

- Advanced battery chemistries like NCA and LFP for performance optimisation.

- Texas lithium refinery aiming to support 1M EVs annually by 2025.

For UK investors, these companies represent a blend of growth potential, innovation, and market resilience in the lithium sector for 2025.

How Can You Use 5StarsStocks.com to Make Smarter Lithium Investments?

5StarsStocks.com equips investors with cutting-edge tools and in-depth resources to make smarter investment decisions in the rapidly growing lithium market. Here are the Features of 5StarsStocks.com:

Expert Advice

5StarsStocks.com offers expert recommendations based on years of industry experience. Their advice helps investors make informed decisions for maximum returns.

Comprehensive Analysis

The platform provides an in-depth analysis of company performance, growth potential, and market trends. This thorough research enables investors to understand the full scope of opportunities in the lithium sector.

Portfolio Diversification

5StarsStocks.com offers strategies for diversifying your portfolio across various lithium-focused industries. This approach helps reduce risk while maximising investment opportunities in the growing lithium market.

By leveraging these tools, investors can stay ahead of market shifts and make data-driven decisions that maximise returns.

How Can You Diversify Your Portfolio with 5StarsStocks.com Lithium?

Diversification is a vital strategy for managing risk and enhancing long-term investment success. 5StarsStocks.com assists investors in building a well-balanced portfolio by offering a range of lithium-focused investment opportunities.

These include mining companies, battery manufacturers, and renewable energy firms, each contributing to the sector’s growth in unique ways.

The platform provides insights into both established leaders and promising newcomers in the lithium industry.

For example, lithium mining companies cater to the raw material demand, while battery manufacturers capitalise on advancements in energy storage technologies. Renewable energy firms also benefit from lithium’s role in grid-scale energy storage solutions.

By diversifying your investments through 5StarsStocks.com, you can mitigate risks associated with market fluctuations and geopolitical instability.

The platform’s expert guidance ensures that your portfolio is not overly reliant on a single sector, giving you a broader stake in the green energy revolution and the growing lithium economy.

What Are the Risks and Rewards of Investing in Lithium Stocks?

Investing in lithium stocks offers significant opportunities, but it’s essential to weigh the risks alongside the rewards.

As one of the most sought-after materials in the clean energy sector, lithium has the potential for strong returns, but it also comes with challenges.

Risks Investing in Lithium Stocks

- Volatility: Lithium prices are highly dependent on supply-demand dynamics, which can lead to market fluctuations.

- Geopolitical Concerns: Mining operations in regions with political instability can disrupt supply chains and affect stock performance.

- Environmental Regulations: Stricter mining and sustainability standards may increase operational costs.

Rewards for Investing in Lithium Stocks

- High Returns: Historical data shows that lithium stocks have consistently outperformed in the clean energy market.

- Market Growth: With the increasing adoption of EVs and renewable energy, demand for lithium is expected to rise exponentially.

- Innovation Opportunities: Companies investing in advanced battery technologies can provide significant gains.

Understanding these factors is crucial to making informed decisions. Platforms like 5StarsStocks.com can help balance these risks and rewards by offering expert insights and detailed analyses of market trends.

How Could 2025 Shape the Future of Lithium Investments?

2025 is poised to be a game-changing year for the lithium market as global demand for this critical resource continues to climb.

Governments worldwide are prioritising clean energy policies and zero-emission targets, creating a surge in demand for lithium-ion batteries. These batteries are essential for electric vehicles, renewable energy storage, and even emerging technologies like electric aviation.

Companies that invest in innovative mining practices and sustainable production methods will likely dominate the market.

Additionally, advancements in battery recycling technologies are expected to reduce costs and improve resource sustainability, further boosting the industry’s growth.

For investors, this means unparalleled opportunities to gain from a booming sector. With platforms like 5StarsStocks.com, you can navigate this dynamic market and identify high-potential stocks that align with your financial goals.

As 2025 unfolds, lithium’s role as a cornerstone of the green energy revolution will become even more evident, making it an ideal time to invest.

Conclusion

Lithium is more than just a metal; it is the foundation of the clean energy revolution. As industries transition to greener alternatives, the demand for lithium will continue to grow.

Investing in lithium stocks now offers a chance to align your portfolio with a sustainable future. By using 5StarsStocks.com, you gain access to expert insights and recommendations, ensuring smarter investment choices.

Start exploring the lithium market today and prepare to benefit from its growth in 2025.

FAQS About 5StarsStocks.com Lithium

How do I start investing in lithium stocks?

Start by researching reliable platforms like 5StarsStocks.com and identifying high-potential lithium companies. Create a diversified portfolio to minimise risks.

Are lithium stocks a long-term investment opportunity?

Yes, lithium’s role in clean energy and EVs ensures its relevance for years to come. The market is expected to grow significantly through 2030.

How does lithium compare to other clean energy investments?

Lithium stands out for its versatility in powering EVs and renewable energy storage. It has a more direct impact on green energy than other resources.

Which sectors rely most on lithium?

The EV industry, renewable energy storage, and consumer electronics are the primary sectors relying on lithium. These industries drive the majority of their demand.

How does geopolitical instability affect the lithium market?

Instability in mining regions can disrupt supply chains and impact prices. However, diversification in sourcing reduces these risks.

Can lithium recycling impact its stock value?

Yes, advancements in lithium recycling can lower costs and enhance sustainability, positively affecting stock performance.

What is the difference between lithium mining and lithium production?

Lithium mining involves extracting raw materials from the earth, while production focuses on refining and converting them into usable forms for batteries and other products.