Table of Contents

Investing doesn’t need to be complicated what matters most is finding strategies that are safe, smart, and capable of producing steady returns over time.

UK investors today face a wide range of choices, but many struggle to identify what truly works, what carries unnecessary risk, and what aligns with long-term financial security.

This guide walks you through the most reliable investment avenues available in the UK and helps you understand how to grow your money steadily without exposing yourself to unnecessary volatility.

Whether you’re a beginner or someone looking to diversify an existing portfolio, this blog covers practical steps, simple explanations, and proven strategies designed for sustainable UK returns.

For more insights, platforms like Live Business Blog often break down safe investment advice in simple terms.

What Are the Safest Investment Options for UK Investors Today?

Safety is the biggest priority for many UK investors, especially those looking for predictable, steady returns rather than risky growth. Several financial products are specifically designed to protect your capital while allowing it to grow modestly.

Comparing Popular Low-Risk UK Investments

| Investment Type | Average Annual Return | Risk Level | Suitable For |

| Cash ISAs | 2%–5% | Very Low | Savers seeking tax-free growth |

| Fixed-Rate Bonds | 4%–6% | Low | Predictable income seekers |

| Premium Bonds | Variable | Very Low | Investors who prefer security over returns |

| Government Gilts | 3%–5% | Low | Long-term safe investors |

| High-Interest Savings Accounts | 3%–7% | Very Low | Emergency fund or short-term savers |

These assets are ideal for those prioritising preservation of capital. Although they may not deliver exceptionally high returns, they add stability and security to your financial plan.

How Do UK Stocks and Shares Help You Build Steady Long-Term Returns?

When approached carefully, UK equities offer strong growth potential while still allowing for consistent long-term returns.

Stocks and shares tend to outperform cash savings over time, and even moderate exposure can significantly grow your wealth.

How Diversification Protects Your Investment Portfolio?

Diversification reduces risk by spreading your money across multiple sectors, asset classes, and regions.

For example, a portfolio that includes FTSE 100 companies, dividend stocks, and global funds is less likely to suffer from market fluctuations compared to a portfolio concentrated in a single sector.

Why Dividend Stocks Offer Reliable Annual Income?

Dividend-paying companies such as utilities, consumer goods, and financial services provide regular payouts and tend to be less volatile.

Dividends can be reinvested automatically to compound wealth or taken as annual income.

Some key benefits include:

- Stable income from large established companies

- Potential for share price growth over time

- Lower volatility compared to growth stocks

Why Should You Consider Low-Cost UK Index Funds and ETFs?

Index funds remain one of the most popular investment options among both beginner and professional investors.

They’re designed to mirror the performance of major indexes such as the FTSE 100, FTSE All-Share, or S&P 500.

The benefits of index investing include:

- Low fees compared to actively managed funds

- Wide diversification automatically built in

- Passive investing no need for daily monitoring

A simple monthly investment into a global index fund can deliver long-term annual returns between 6% and 10%, depending on market conditions. Over several decades, compounding can turn small monthly contributions into a substantial sum.

What Role Does Property Investment Play in Generating Steady UK Returns?

Property remains a cornerstone of UK wealth building because it provides both capital appreciation and rental income.

Investors today have more options than ever, even if they don’t want to become traditional landlords.

Buy-to-Let Property and Rental Income

Rental demand remains high across the UK, especially in cities such as Manchester, Birmingham, Bristol, and London. Buy-to-let provides long-term rental income along with gradual property value growth.

However, investors should be aware of:

- Higher mortgage rates

- Tax implications

- Maintenance costs and management fees

Property Crowdfunding and REITs

For those who want property exposure without the responsibility of owning a building, REITs (Real Estate Investment Trusts) and crowdfunding platforms offer a hands-off route.

Benefits include:

- Lower entry costs

- No direct landlord responsibilities

- Exposure to commercial, residential, and mixed-use properties

How Can You Build Steady Returns Using UK Savings and Fixed-Income Products?

Savings and fixed-income products provide predictable growth. Although the returns are modest compared to stocks, the security they offer makes them essential for a balanced investment strategy.

Examples include:

- Fixed-term savings accounts

- Corporate bonds

- Government gilts

- Regular saver accounts

These products are especially suitable for individuals seeking guaranteed returns without taking significant risks.

What Investment Strategy Should You Follow for Consistent UK Returns?

Choosing the right investment strategy depends on your goals, timeline, and risk tolerance. A steady-returns approach typically blends both growth assets and safe assets.

Example of a Balanced UK Investment Portfolio

| Asset Category | Suggested Allocation | Purpose |

| Index Funds | 40% | Long-term growth |

| Government Gilts | 20% | Portfolio stability |

| UK Dividend Stocks | 15% | Income + moderate growth |

| Property/REITs | 15% | Passive income |

| Cash Savings/ISAs | 10% | Emergency buffer |

This structure provides long-term compounding through equities while balancing risk with low-volatility assets.

How Can You Start Investing Safely If You Are a Beginner in the UK?

If you’re new to investing, taking small steps can help you build confidence while avoiding early mistakes. Here are simple yet effective guidelines:

- Begin with low-cost index funds

- Start with monthly automatic contributions

- Build an emergency fund before investing

- Avoid high-risk schemes or unregulated investments

For beginners who want a clear roadmap, exploring trusted financial guides can help you shape a safe long-term plan. Resources that explain smart ways to invest your moneycan give you a structured understanding of how to start slowly, reduce risk, and build stable returns over time.

When Should You Use Professional Advice to Plan Your UK Investments?

Financial advisers can help if you are:

- Planning for retirement

- Managing a large lump sum

- Unsure about tax implications

- Trying to diversify a complex portfolio

Professional advice ensures your investments align with both long-term goals and personal finances, especially when dealing with tax-efficient strategies like pensions, ISAs, and inheritance planning.

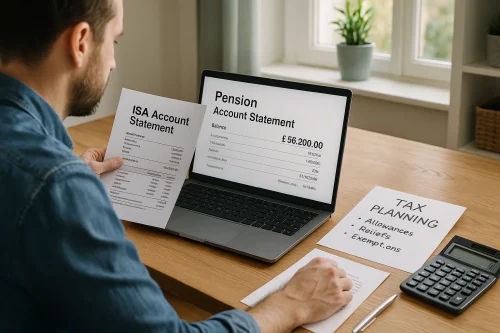

Which Tax-Efficient Accounts Should You Use for Steady UK Returns?

Maximising returns isn’t just about choosing the right investments it’s also about making sure you use tax-efficient accounts that allow your money to grow without unnecessary deductions.

The UK offers several powerful tax wrappers that can protect your savings and investments, ensuring you keep more of what you earn.

These accounts reduce or eliminate taxes on interest, dividends, or capital gains, making them essential for anyone aiming for steady long-term returns.

Individual Savings Accounts (ISAs)

ISAs are among the most accessible and popular investment vehicles in the UK. Every adult can invest up to £20,000 per tax year, and all growth inside the ISA whether from savings interest, dividends, or investment gains is completely tax-free.

There are multiple types of ISAs:

- Cash ISA: Works like a savings account but shields interest from tax. Good for low-risk savers.

- Stocks and Shares ISA: Allows you to invest in funds, ETFs, shares, and bonds without paying dividend or capital gains tax.

- Lifetime ISA (LISA): Provides a 25% government bonus (up to £1,000 per year) for first-time buyers or retirement savings.

- Innovative Finance ISA: Invests in peer-to-peer lending platforms, offering higher returns but with greater risk.

Why ISAs Matter for Steady Returns?

They allow you to grow your wealth without worrying about tax eroding your gains. For long-term investing, a Stocks and Shares ISA is particularly powerful because compounding happens faster when no tax is deducted each year.

Workplace and Private Pensions

Pensions are one of the most effective long-term investment tools, mainly because of the generous tax relief and potential employer contributions.

There are two main types:

- Workplace Pensions (Auto-Enrolment Schemes)

- You contribute a percentage of your salary.

- Your employer must add their own contribution.

- The government adds tax relief, boosting your pot further.

- Personal and Self-Invested Personal Pensions (SIPPs)

- Ideal for those wanting full control over their investments.

- You choose your own funds, shares, or portfolio strategies.

- Suitable for self-employed individuals or side-income earners.

Why Pensions Boost Steady Returns?

The tax relief is exceptionally strong. For every £80 you contribute, the government tops it up to £100. Higher-rate taxpayers can claim even more. Over decades, this turbocharges long-term growth and retirement stability.

General Investment Accounts (GIAs) with Tax Allowances

A GIA doesn’t provide tax sheltering like an ISA or pension, but it does let you invest without contribution limits. You can reduce your tax liability using:

- Dividend allowance

- Capital gains tax allowance

- Interest allowances (personal savings allowance)

These allowances can help small or moderate investors keep taxes low.

Premium Bonds

Premium Bonds, operated by NS&I, do not pay interest but instead offer tax-free prize draws. Although returns are not guaranteed, they are fully backed by HM Treasury, making them one of the safest savings products in the UK.

Using ISAs and Pensions Together

Most UK investors maximise steady returns by using a combination of:

- Stocks and Shares ISA for flexibility

- Pension for heavy tax efficiency and long-term compounding

- Cash ISA or savings accounts for short-term safety

This blend ensures growth, security, and tax protection—crucial for building long-lasting wealth.

Are There Mistakes You Should Avoid When Trying to Grow Your Money Safely?

Even the safest strategies can fail if common mistakes aren’t avoided. Some of the most frequent errors include:

- Chasing high-risk schemes promising unrealistic returns

- Investing without building an emergency fund

- Putting all money into a single asset class

- Ignoring tax allowances

- Allowing emotions to influence investment decisions

Avoiding these mistakes helps protect your savings and encourages slow but consistent financial growth.

Final Thoughts

Smart and safe investing is not about timing the market—it’s about choosing the right strategies, diversifying your assets, and allowing compounding to work for you.

Whether you prefer low-risk options like bonds and ISAs or you are comfortable with long-term equity growth, the key is to remain consistent, disciplined, and informed.

By following the strategies outlined here, UK investors can build a strong financial foundation with steady and secure returns over time.

FAQs

What is the safest way to invest money in the UK?

Low-risk options like Cash ISAs, premium bonds, and government gilts offer secure and steady returns with minimal risk.

How much should a beginner invest each month?

Start with an amount that fits comfortably within your budget many beginners begin with £50–£200 per month.

Are index funds good for long-term UK investors?

Yes, index funds provide diversification, low fees, and consistent long-term performance, making them ideal for steady growth.

Can I lose money in a Stocks and Shares ISA?

Yes, investments can rise and fall, but long-term diversified portfolios tend to recover and grow over time.

Is property still a good investment in the UK?

Property can offer strong rental demand and long-term capital growth, especially when using REITs or buy-to-let strategically.

How important is diversification for steady returns?

Diversification spreads risk across assets, reducing the impact of market dips and helping maintain stable returns.

Do I need a financial adviser to start investing?

Not necessarily many beginners use low-cost platforms, but an adviser can help if you have complex goals or large amounts to invest.