Table of Contents

Retirement often brings a change in income sources, with pensions replacing salaries. While many pensioners do not need to submit a tax return, others may still have to, depending on their financial situation.

Understanding if and when a tax return is required is essential to avoid penalties and stay in line with tax regulations.

This blog provides a clear and comprehensive guide to help pensioners understand their tax responsibilities in the UK.

What Determines If a Pensioner Must Submit a Self Assessment Tax Return?

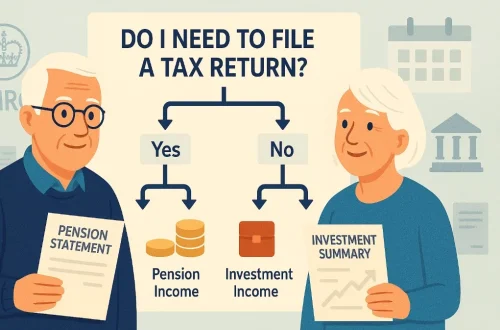

Whether a pensioner must file a Self Assessment tax return depends on the nature and amount of income they receive. If their total taxable income exceeds the personal allowance, they may need to report it. This includes income from private pensions, state pensions, savings, rental properties, or other sources.

Pensioners who only receive the state pension and have no other earnings often fall below the tax threshold and are exempt from filing. However, those with additional income sources or untaxed earnings must assess their tax situation.

- HMRC will typically notify individuals if they are required to file.

- It’s the pensioner’s responsibility to check if untaxed income could push them above the allowance.

Understanding these rules helps pensioners stay compliant and avoid unexpected tax liabilities.

When Does Untaxed Income Require a Tax Return?

Untaxed income becomes taxable when it causes total earnings to exceed the personal allowance threshold.

Pensioners receiving income such as rent, dividends, or investment gains may be required to report this via Self Assessment. If the income is not taxed at source, it needs to be declared.

| Type of Untaxed Income | Requires Self Assessment? |

| Rental income | Yes |

| Dividends over allowance | Yes |

| Capital gains on shares | Yes |

| Interest from savings | Sometimes (if over limit) |

| Foreign pension income | Yes |

If your income comes from multiple sources, even if each one is small, the total may still exceed the allowance, making a tax return necessary.

What Role Do Multiple Income Sources Play?

Multiple income sources can complicate your tax situation. A pensioner may receive a modest state pension but also earn money through investments, part-time work, or rental properties. These combined incomes can push them into a taxable bracket.

- State pension plus private pension may exceed the personal allowance.

- Rental income adds to the total earnings and must be declared.

- Interest or dividend income, even if small, is taxable above certain thresholds.

Managing multiple incomes requires careful tracking to ensure you meet your tax obligations.

Is Your State Pension Taxed Automatically or Through Self Assessment?

The state pension is considered taxable income, but it is paid without tax deducted at source. If the state pension is your only income and remains below the personal allowance, no tax or return is usually required.

However, when combined with other taxable earnings, it may push your income above the threshold. In many cases, tax is collected through PAYE on another income source, such as a private pension.

HMRC may adjust your tax code to account for the tax owed on the state pension. If tax can’t be collected automatically, a Simple Assessment or Self Assessment may be issued.

What Types of Pensioner Income Require You to File a Tax Return?

Pensioners with various income sources may be required to complete a Self Assessment tax return. These incomes are often not taxed at source or are insufficiently taxed, requiring you to declare them yourself.

Here are common types of pensioner income that may necessitate tax reporting:

- State Pension: Taxable, even if tax isn’t deducted at source.

- Private/Occupational Pensions: Usually taxed through PAYE but may still require a return if combined income exceeds allowance.

- Savings and Investments:

- Bank interest

- Dividends from shares

- Capital gains from asset sales

- Rental Income:

- Buy-to-let properties

- Holiday rentals

- Self-Employment:

- Consulting

- Freelance work

- Foreign Income:

- Overseas pensions

- Foreign property income

If your total income from any combination of these sources exceeds the personal allowance, you’ll likely need to file.

What Is Simple Assessment and How Does It Affect Pensioners?

Simple Assessment is a system used by HMRC to calculate and collect tax without requiring the taxpayer to file a Self Assessment return.

This is ideal for pensioners with relatively straightforward tax affairs. HMRC will calculate what you owe based on information already available from pension providers and financial institutions.

You’ll receive a PA302 letter with the amount due and payment instructions.

- No need to file a tax return

- Tax calculated automatically using known income

- Must pay by the deadline stated in the letter

Simple Assessment is beneficial for pensioners with state pensions and small amounts of additional income.

When Will HMRC Send a Simple Assessment Letter?

HMRC typically sends Simple Assessment letters between July and August after the tax year ends. This letter outlines the tax you owe based on income sources such as state pensions and other benefits.

You should review the letter carefully to confirm that all details are accurate. If the information is incorrect or incomplete, it’s important to contact HMRC within 60 days. The assessment must be paid by the date stated, usually by 31 January or three months from the issue date.

Limitations of Simple Assessment

While Simple Assessment helps many pensioners avoid the full Self Assessment process, it does come with limitations. It is only suitable for individuals with straightforward income and minimal complexity in their financial affairs.

Those with multiple income streams, rental income, capital gains, or self-employment income typically do not qualify.

| Suitable For | Not Suitable For |

| Basic pension income | Rental income above allowances |

| Limited untaxed savings (under £10,000) | Significant capital gains or asset sales |

| PAYE and state pension only | Self-employed pensioners or freelancers |

| No need to claim deductions or reliefs | Those with complex income or dual residency |

In such cases, HMRC will ask the individual to complete a full Self Assessment instead of relying on Simple Assessment.

How Can Pensioners Check If They Need to File a Tax Return?

It’s essential for pensioners to verify whether they are required to file a Self Assessment return. Not everyone is automatically informed, so using available tools and understanding income thresholds is key.

Use HMRC’s Online Tool

HMRC offers a helpful online checker that determines whether you must complete a return based on your income sources and amounts.

Review Your Income Sources

Add all taxable income from pensions, investments, and other earnings. Compare it against your personal allowance.

Understand Your Tax Code

A tax code adjustment may mean HMRC is already accounting for your tax, but don’t assume it’s correct. Errors in your code could lead to over- or underpayment.

What Happens If a Pensioner Ignores a Self Assessment Notice?

Ignoring a Self Assessment notice can have serious consequences. HMRC does not take non-compliance lightly and can impose financial penalties and legal actions.

Here’s what can happen:

- Late Filing Penalties:

- £100 fine immediately after the deadline

- Daily penalties of £10 per day after 3 months (up to £900)

- Late Payment Penalties:

- Interest accrues from the due date

- HMRC Action:

- May issue a Simple Assessment or estimated bill

- Initiate debt recovery through pension deductions or legal action

Avoiding these outcomes is possible by responding promptly and filing on time.

How Do Pensioners File a Self Assessment Tax Return Efficiently?

Filing a Self Assessment return may sound daunting, but with the right preparation and timely action, it can be a smooth process. It’s particularly important for pensioners with more than one income source or those receiving income not taxed at source.

Follow These Steps to File Efficiently:

- Register Early: If you’re new to Self Assessment, register online with HMRC early in the tax year to avoid delays.

- Gather All Income Documents:

- P60 from pension providers

- Interest statements from banks

- Dividend certificates

- Rental statements

- Complete the Return: Use HMRC’s online platform or post a paper return. Double-check entries to avoid errors.

- Submit and Pay: Paper returns are due by 31 October, and online by 31 January. You must pay any tax owed by the same date.

Organising paperwork and seeking help from an accountant can make this process even easier.

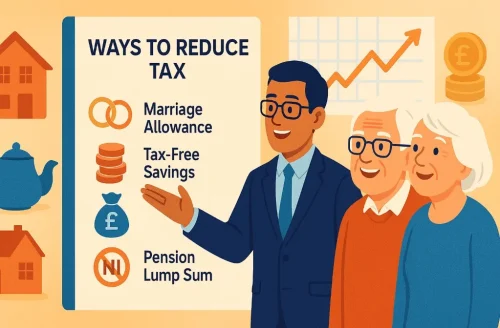

How Can You Reduce Your Tax Bill in Retirement?

Many pensioners aren’t aware of the legal tax reliefs and allowances they can claim. Taking advantage of these can significantly reduce your overall tax liability and help you preserve more of your retirement income.

- Marriage Allowance: Transfer part of your allowance to your spouse if they earn less.

- Savings Allowance: Basic-rate taxpayers can earn up to £1,000 in tax-free savings interest.

- Capital Gains Allowance: If you sell shares or property, the first portion of gains is tax-free up to a set limit.

- Tax-Free Lump Sum: You can take up to 25% of your private pension tax-free, subject to maximum limits.

- No National Insurance: Once past retirement age, you no longer pay NI, reducing your deductions.

Reviewing your financial plan annually can help ensure you’re making full use of these opportunities.

What If You’ve Paid Too Much Tax on Your Pension?

It’s not uncommon for pensioners to overpay tax, often due to miscalculations in tax codes or incorrect income reporting. If you believe you’ve overpaid, you should take steps to request a refund from HMRC.

Start by checking your current tax code. If it doesn’t reflect your personal allowance or income streams correctly, request an update. Then:

- Submit a P53 if you’ve taken a small lump sum

- Use P55 for flexible pension withdrawals

- Wait for a P800 tax calculation from HMRC, which may be issued if they detect an overpayment

Refunds are typically processed within a few weeks. Keeping all income records helps speed up the claims process

Conclusion

Not all pensioners are required to file a tax return in the UK, but those with untaxed or additional income may need to. Staying aware of income thresholds, tax codes, and HMRC notices can help you remain compliant.

Filing on time and using available allowances can reduce your tax burden. If in doubt, always consult a tax professional or use HMRC’s tools for guidance.

Frequently Asked Questions

Are state pensions always tax-free in the UK?

No, state pensions are taxable, but they are only taxed if your total income exceeds the personal allowance.

Can I be taxed on savings interest if I’m retired?

Yes, interest is taxable if it exceeds your Personal Savings Allowance, which varies based on your income tax band.

Do I need to include foreign pension income in my tax return?

Yes, foreign pension income must be declared and may be subject to UK tax depending on double taxation agreements.

How can I update an incorrect tax code as a pensioner?

You can update your tax code by logging into your Personal Tax Account or contacting HMRC directly.

Will selling property during retirement affect my tax obligations?

Yes, selling property may lead to capital gains tax if the gain exceeds the annual CGT allowance.

Do I need to file a return if my spouse and I both receive pensions?

Only if your individual income exceeds the tax-free allowance or involves untaxed income that must be reported.

How do I claim tax relief as a retired person?

You can claim tax reliefs like Marriage Allowance or Savings Allowance through your HMRC account or tax return.